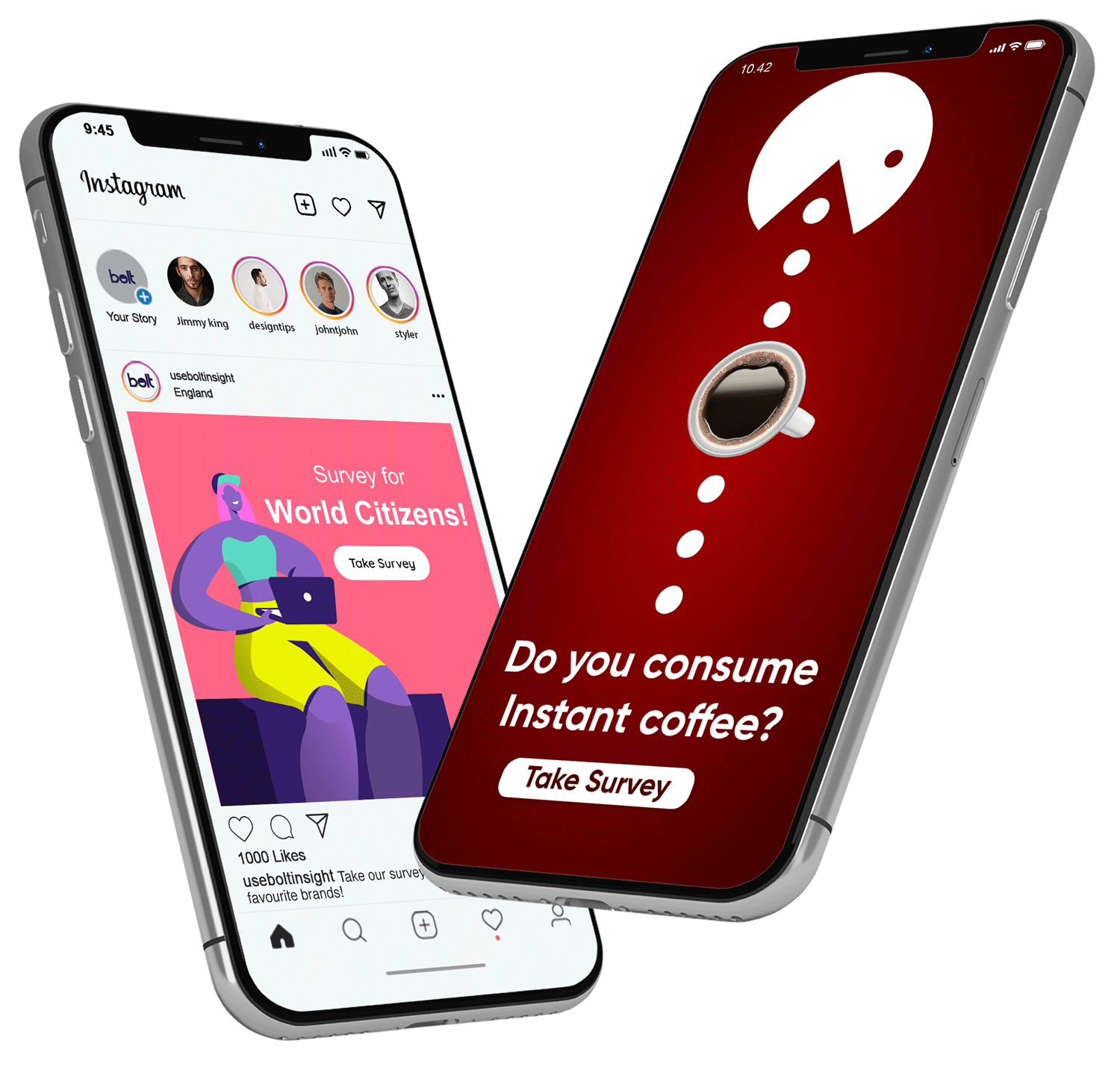

Bolt Insight is the first real-time digital market research platform driven by people’s unique behaviours and interests.

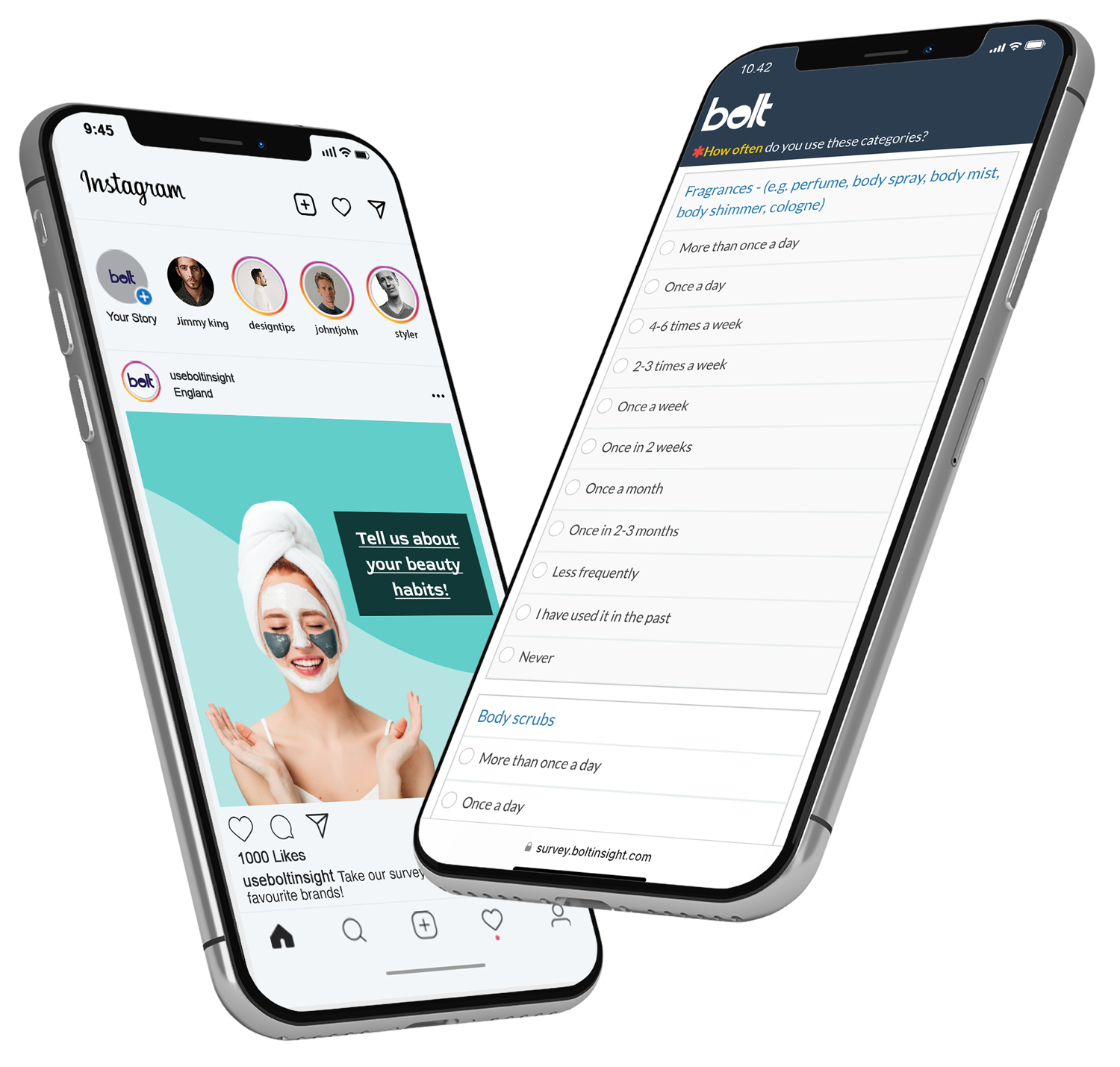

Connect with consumers specifically targeted to be relevant to your brand or campaign directly through the social media and mobile apps they use every day.

We are proud to share our clients’ opinions

We offer tailored quantitative and qualitative solutions according to your needs.

- How is my latest idea or concept performing, and what are the underlying reasons why?

- What are my customer’s defining behaviours, and how are they acting when interacting with my product or category?

- How effective is my advertisement pre or post airing, and what are the key opportunities and areas for improvement?

- Who are the key opinion leaders and influencers that I need to prioritise and will be best suited to drive my brand and innovation equity and imagery?

- How is my brand’s profile, imagery and positioning performing versus my key competitors, and what are my key areas of opportunity?

- Who are my shoppers, what are their motivations, preferences, barriers and behaviours? And how can I optimise in-store performance for my product?

- What are the keys to effectively drive continuous improvement and truly optimise my customer journey, drive loyalty, and reduce churn across my core customer base?

Hyper-targeted high-quality audiences at your fingertips

The human and technology identity platform for direct qualitative consumer connection.

Our platform provides an engaging experience for consumers and clients alike, by allowing consumers to share their opinions easily by directly messaging and allowing clients to CHOOSE who they want to talk to, CHAT with them and CONNECT the dots to analyse the key insights.

An innovative consumer-centric approach to help you identify potential growth opportunities every day.

Get to know what your customers want by talking to them.

We help our clients make sense of the diverse, disaggregated data that truly reflects the human behaviour of their customers.

• We custom design a survey based on your business questions.

• We recruit via social media and in-app advertising for highly engaged audiences.

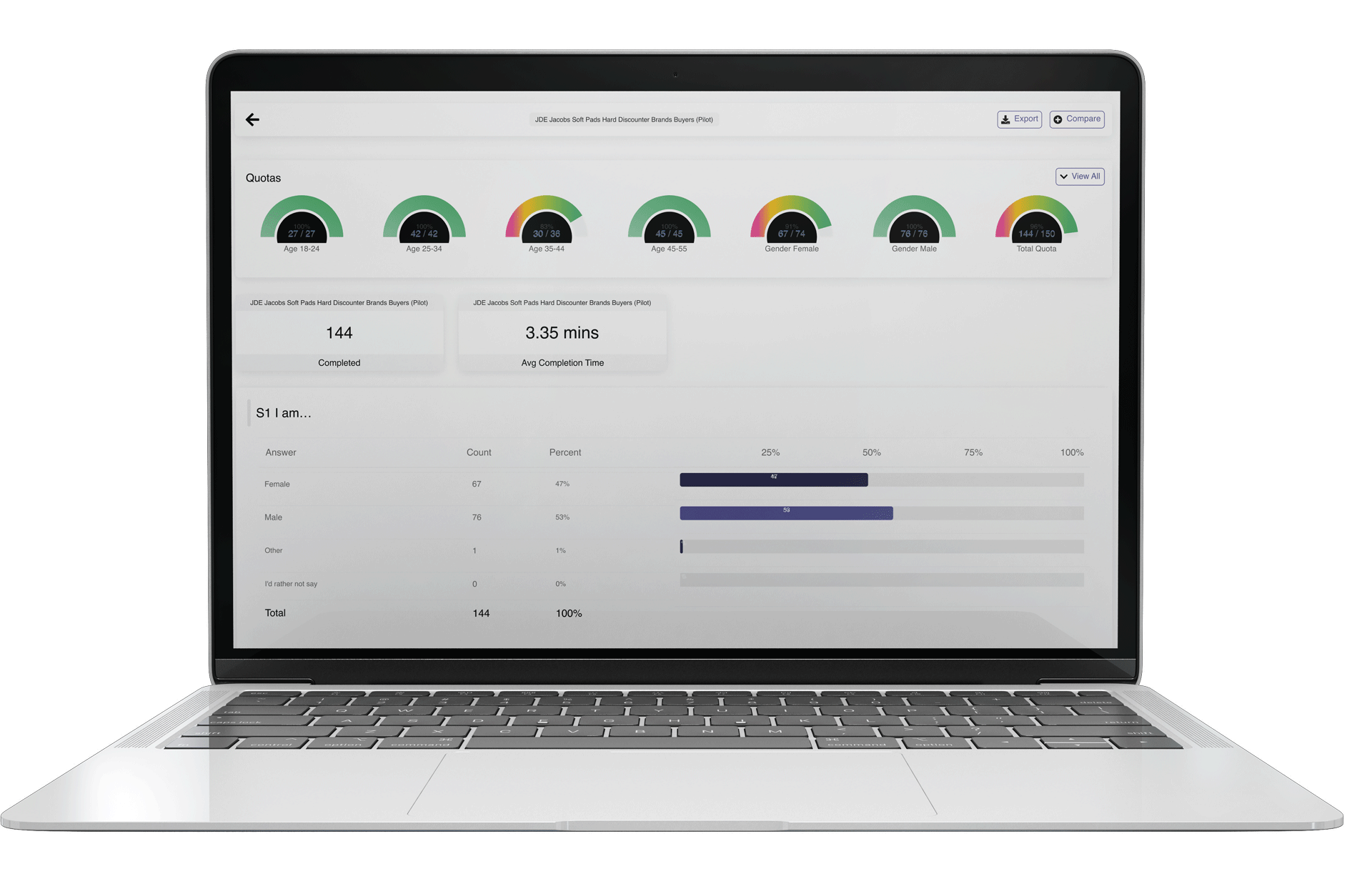

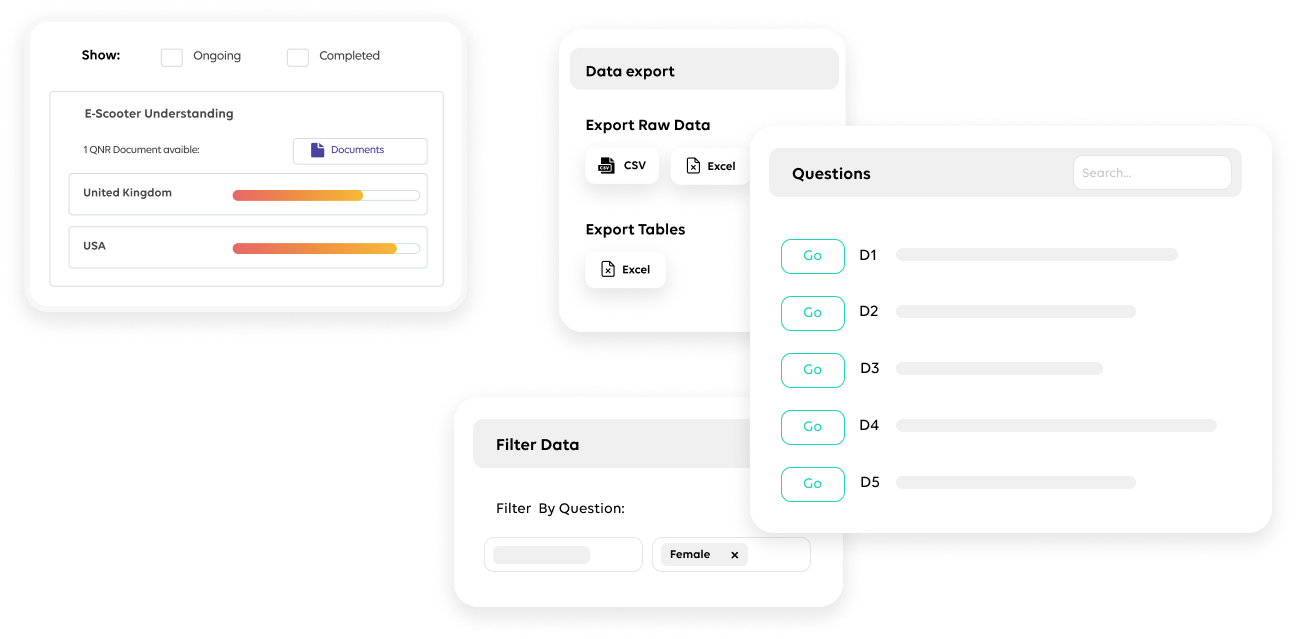

• You monitor your results in real-time with our fully interactive dashboard.

• You get hands on consultancy and research services as our team walk you through all results.

Get quick printouts thanks to the

easy-to-use platform.